A Look Into The Cybersecurity Sector and Three Major Players

I compare 3 Primary Cybersecurity stocks: CRWD, OKTA, & ZS

Hello Everyone!

Thankful to have you on board! If you are not yet subscribed to our Newsletter, ensure you sign up below for FREE in order to have these delivered straight to your email.

Today we are going to discuss a sector I am very upbeat on over the next decade and that is the Cybersecurity industry. Based on the movement to a more digital and work from home environment, cybersecurity is no longer an option, it is a ‘must have’ in order to protect company information from ferocious hackers. More and more cyberattacks are happening every day, thus the need for strong cybersecurity companies from all ends of the spectrum.

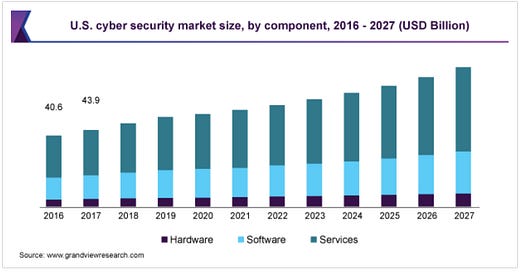

The Cybersecurity sector is one that is expected to grow an average of 10% per year through 2027. The cybersecurity Total Addressable Market (TAM) in 2020 was estimated to be $167 Billion. By 2027, the TAM is expected to be north of $326 Billion.

Without further adieu, let’s begin with 3 of the more well-known Cybersecurity stocks CrowdStrike Holdings, Inc (CRWD), Okta, Inc. (OKTA), and Zscaler (ZS).

1. CrowdStrike Holdings, Inc.

Symbol: CRWD

Stock Price: $222.36

Market Cap: $49.5 Billion

YTD Growth: 5.5%

2019 Revenue: $484.1 Million, +93% YOY Growth

2019 Gross Margins: 71.5%

2020 TTM Revenue: $761.6 Million, +85.9% YOY Growth

2020 TTM Gross Margins: 72.9%

BUSINESS SUMMARY:

CrowdStrike is the most well-known sole cybersecurity stock in the market today. Larger companies such as Microsoft and Cisco are involved in the space, but they are not all in on cybersecurity similar to the likes CrowdStrike and the other two companies we will discuss today.

CRWD was founded in 2011 to “reinvent security for the cloud era.” The company’s flagship product, the Falcon cloud platform, detects threats and halts data breaches through the likes of Artificial Intelligence. The company is led by Co-Founder George Kurtz.

The company is also often used for remediation, meaning CrowdStrike is often called after the fact as well, for companies that did not have proper cybersecurity protection and were breached. For example, Solarwinds was a high profile breach to which they called CrowdStrike to remediate the breach and determine the weak point of the company’s technology.

Recent Results:

The company earns roughly 92% of their Revenue from the Subscription segment, which earns a gross margin of 76.3%. The company has done a fine job lowering their expenses year-over-year.

TTM Sales & Marketing Exp: $364.7 Million; 47.9% of sales

PY Sales & Marketing Exp: $240.1 Million; 58.6% of sales

TTM R&D Exp: $187.3 Million; 24.6% of sales

PY R&D Exp: $113.5 Million; 27.7% of sales

Operating income/(loss) has increased 26% YOY, though the company is still reporting a loss of $107.9 Million. The operating improvement is largely related to the increased gross margins and operating margins as well. The company is still operating at a negative operating margin, but like I mentioned above, they have made drastic improvements on a quarterly basis. Operating margins a year ago were -35.7% compared to -14.2% as of the most recently reported data. Operating margins have improved four out of the past five quarters.

In terms of cash flow, a year ago was when the company began turning consistent Free Cash Flow, which is up over 9x from 12-months ago. Here is a look at some more results from the most recently reported quarterly earnings.

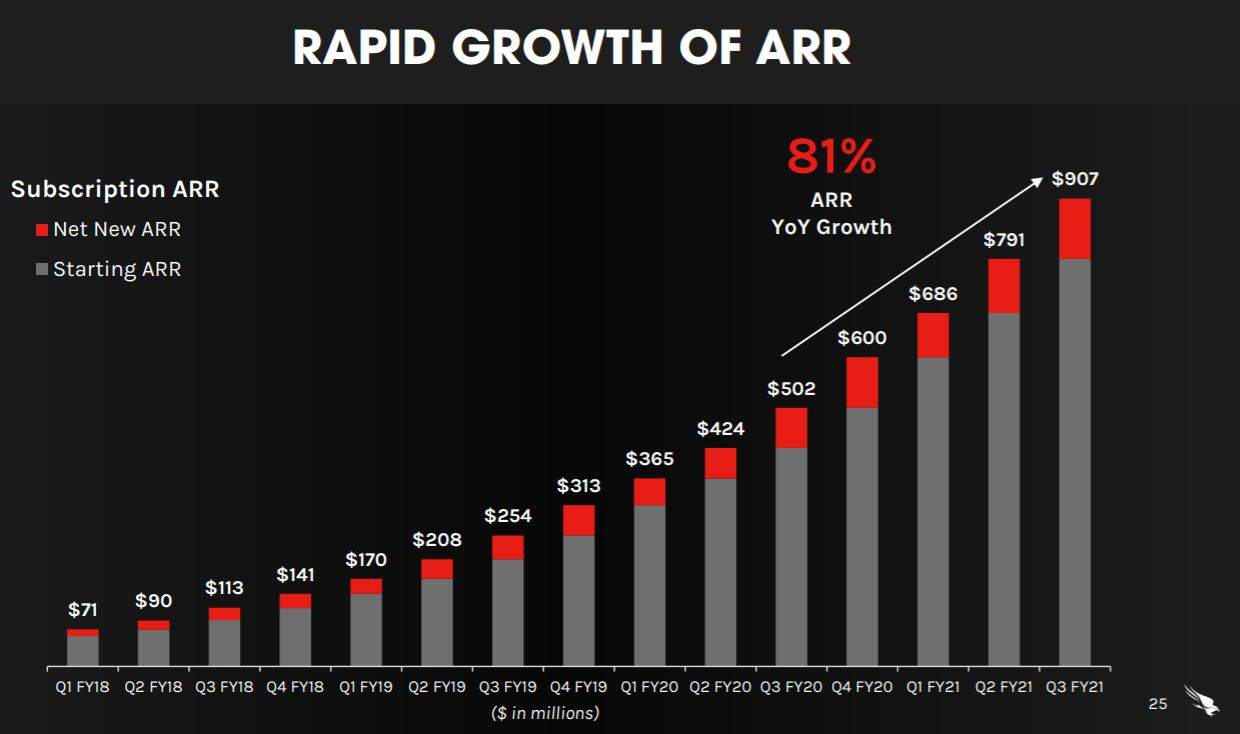

Annual Recurring Revenue is a closely watched metric in the industry. ARR is great for business due to its low turnover and predictability. Look at the company’s ARR growth each quarter, which has gone from $113 million Q3 ‘18 to $907 million.

2. Okta, Inc. (OKTA)

Symbol: OKTA

Stock Price: $281.15

Market Cap: $36.6 Billion

YTD Growth: 10.6%

2020 Revenue: $586.1 Million, +47% YOY Growth

2020 Gross Margins: 71.6%

2021 TTM Revenue: $768.0 Million, +43.8% YOY Growth

2021 TTM Gross Margins: 73.8%

BUSINESS SUMMARY:

The second business we will discuss today is Okta, another cybersecurity company that is also Founder led, which is something I like to see in strong growth stocks. The two founders are CEO/Co-Founder Todd McKinnon and COO/Co-Founder Frederic Kerrest.

Okta was founded in 2009 and their main focus has been on that of single sign-on. These days employees have numerous applications they utilize, Okta allows for a single sign-on that not only provides efficiencies, but also user security.

Like CRWD, Okta is also focused on the subscription based model, which provides those high retention rates an opportunities for cross-selling. Okta has over 9,400 customers now, including the likes of the US government.

Recent Results:

Through the company’s first 3 quarters of their fiscal 2021 year, roughly 95% of their Revenue comes from the Subscription segment, which earns an incredibly high gross margin of 78.7%. Here is a look at the company’s primary operating expenses:

TTM Sales & Marketing Exp: $404.8 Million; 52.7% of sales

PY Sales & Marketing Exp: $310.3 Million; 58.1% of sales

TTM R&D Exp: $203.9 Million; 26.5% of sales

PY R&D Exp: $145.9 Million; 27.3% of sales

Okta has done a fine job lowering operating expenses, but the change has not been as drastic as what we have seen over at CRWD. Okta has slightly higher Gross Margins, but their operating margins over the past twelve months is much lower than CRWD, and something that needs to be addressed.

Operating cash flow is up roughly 2x on the year with Free Cash Flow up 3x in the same period. Calculated Billings for the company have grown at a strong clip over the past few years from $96 million in Q1 2019 to $252 million in Q3 2021.

3. Zscaler, Inc. (ZS)

Symbol: ZS

Stock Price: $215.87

Market Cap: $29.1 Billion

YTD Growth: 8.1%

2020 Revenue: $431.3 Million, +42% YOY Growth

2020 Gross Margins: 77.8%

2021 TTM Revenue: $480.3 Million, +44.2% YOY Growth

2021 TTM Gross Margins: 77.5%

BUSINESS SUMMARY:

Zscaler is the last cybersecurity or Security as a Service as they like to put it, that we will discuss today. Similar to the other two names mentioned, ZS focuses on single sign-on and safe endpoint access, something extremely important in today’s working environment. VPN has been a major focus for the company of late, which allows users to sign into their applications safely no matter where they are.

ZS was founded in 2007, making them the oldest of the three companies we discussed today. Zscaler Internet Access or ZIA and Zscaler Private Access or ZPA, are two of the main flagship products for the company that secure internet browsing and access to company applications.

Recent Results:

Zscaler reports revenue as one single reportable segment. The company produced a gross margin of 77.5% over the past four quarters and continues to see strong demand for their products. Here is a look at the company’s primary operating expenses:

TTM Sales & Marketing Exp: $315.5 Million; 65.7% of sales

PY Sales & Marketing Exp: $192.8 Million; 57.9% of sales

TTM R&D Exp: $113.4 Million; 23.6% of sales

PY R&D Exp: $69.1 Million; 20.7% of sales

ZS continues to grow at a strong clip, with revenues increasing 52% in the most recent quarter. 2021 continues the growth as the guidance management gave is expecting roughly 40% growth for the year.

Again, Annual Recurring Revenue is big for these cybersecurity companies and a closely watched metric. In the most recent earnings, the company’s ARR grew 64% and is up 46.5% over the past year.

FINAL THOUGHTS

Over the years, the trend has continually seen more and more enterprises move data to the cloud, however, the COVID-19 pandemic has further accelerated the trend as more and more business implement work from home policies. This has put company data at risk and cybersecurity as a huge beneficiary.

All three of these business are great standalone businesses within the cyber industry, but I believe Crowdstrike is the leader.

Crowdstrike continues to see the strongest revenue growth, as they continue to take more market share, combined with the fact that management has done a superb job at running the business extremely efficiently.

In terms of valuation, CRWD is the more expensive stock, but for good reason.

Forward P/S

CRWD: 60.7x

OKTA: 48.9x

ZS: 51.3x

EV/S

CRWD: 63.5x

OKTA: 46.7x

ZS: 59.4x

CRWD is crushing the other two in terms of Revenue, Operating Income, and Adj EPS growth over the past year. The cybersecurity market will only continue to grow and all three of these companies will certainly benefit.

Disclaimer: This post is intended for informational purposes only. The information is not intended to facilitate an investment decision. Do ensure you understand that each investment involves a level of risk, so please ensure you perform your own due diligence prior to making any investment. Past performance is not guarantee future profits.