Seeker Newsletter - Week of Aug 31st 2020

The S&P 500 is now trading at an earnings multiple twice the normal average. Tesla & Apple begin trading at their split adjusted price this week.

Good Morning,

I hope everyone had a great weekend and you are ready for another week of investing. The market’s are getting ready to open in a few hours, so let’s get prepared for the week.

Before I dive in, I have some changes to announce. I will be breaking up the newsletter into multiple days. The Monday edition is still the primary newsletter, but the Tuesday edition will go into more stock charts and investment ideas. The “Stock In The Spotlight” edition will still remain a separate write-up during the week as well.

The reason I am having to make this switch is due to the fact Substack only allows a set limit on articles, as such, in order for me to add the in-depth information I am trying to deliver to you, this was the recommended change.

As such, as a subscriber, you will now receive:

Monday - Seeker Newsletter

Tuesday - Quick Picks

Mid-Week - Stock In The Spotlight

I have received some requests from a few of you looking for an educational write-up, which could replace the “Stock In The Spotlight” segment some weeks. Look for this coming soon and let me hear from you regarding any requests you may have.

Now that we have that behind us, let’s dive in!

Stock Market Update

The BIG week has arrived! You may be asking yourself, what are you talking about Mark? The week Apple and Tesla shares begin trading at their split adjusted prices. Since announcing their stock split- shares of Tesla have increased over 60%. My question to those folks is, what has changed in the business during the past few weeks, besides a stock split which adds ZERO value, to warrant that type of increase?

Let me answer, NOTHING.

Remember, if you own a stock that is priced at $400 and is doing a 4-1 stock split, meaning you will own 4 shares at the new $100 price, either way you still own $400 worth of stock.

If that stock increases 5%, you earn 5% on the amount you have invested, not on the number of shares you have.

Both Tesla and Apple both have HUGE retail followings, so it will be interesting to watch how things shake out.

In other news, Congress is still at an impasse regarding the next round of coronavirus aid, which could put a damper on the economy if it drags on.

However, the Fed continues to do everything they can to keep the market pointed UP. The Federal Reserve announced plans to “achieve inflation that averages 2% over time.” In the past, the target has been 2%, but now they have inserted the word “average” which could suggest this low rate environment is here for awhile.

We will continue to watch and listen for updates regarding a vaccine. The FDA is ready to put any potential vaccine through a fast approval process, which will eventually catapult the markets even higher once that become fruition.

Also, initial jobless claims once again rose above the 1 million level, so that will be something to watch as well during the week.

This past week we again saw record highs in the stock market. I think when it comes to the federal reserve the floor is much higher, but given that we are at record highs, roughly double the normal valuation of the S&P 500, I believe the near-term downside is much greater than upside potential.

However, I plan to continue investing, but in smaller doses to ensure I have cash on the side in the event the market sees a sizable pullback.

With that being said, let’s take a look at t he market performance for the major averages.

YTD/Previous Week:

Dow: 0.4% Dow: +2.6%

S&P 500: +8.6% S&P 500: +3.3%

Nasdaq: +30.3% Nasdaq: +3.4%

We have started to see some movement from value names, but nothing huge yet. Some of my REIT investments saw some nice moves, including one of my favorites lately, STORE Capital (STOR), which saw nearly a 5% move on the week.

Many eyes are still watching who comes away acquiring Tik Tok. Microsoft and Oracle were the two big names bidding against one another, until news broke last week that Walmart could be teaming up with Microsoft to bid on the Chinese tech asset.

Though many of the earnings reports are done, there is still plenty going on to keep up with and keep us busy.

Watchlist

Here are a few names I will be watching this week.

$JNJ $ABBV, $BMY, $RTX, $LMT $GD, $T, $TDOC, $DOCU

Pharmaceuticals and Defense are still two sectors I believe to be undervalued. In addition, it was reported on Friday that AT&T is exploring options of selling DirecTV, which would be a big boost towards the company further paying down the mountain of debt they have.

Defense I expect to trade sideways until the election, but either way Defense is not going anywhere and is a safe and reliable investment for the long-term. All these names I mentioned are trading well-below their five-year average valuations across many different metrics.

Normally I would go into a few charts on stocks that are setting up for a bounce or looking stretched from a technical standpoint, but this will now be discussed in more detail in the second part published tomorrow.

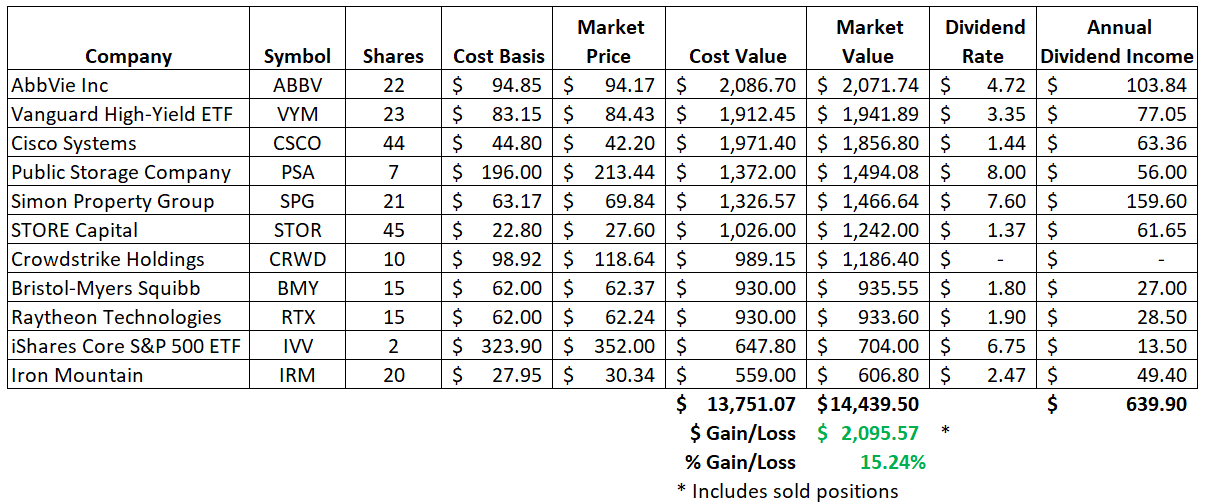

Seeker Portfolio

The Seeker Portfolio was started at the beginning of August with $10K as a way for many of you to follow along on building a portfolio and the moves I am making. This past week, I transferred another $10K to the portfolio.

Additions this week:

BUY 20 shares of Cisco Systems (CSCO) at a cost of $41.87. This purchase adds $29 of annual dividend income.

BUY 23 shares of Vanguard High Dividend ETF (VYM) at a cost of $83.15. This purchase adds $77 of annual dividend income.

BUY 2 Call Options in Fastly (FSLY). The options were Jan 15 2021 options with a strile of $100. I paid a premium of $15.40 each.

BUY 15 shares of Raytheon Technologies (RTX) at a cost of $62.00. This purchase adds $29 of annual dividend income.

BUY 15 shares of Bristol-Myers Squibb (BMY) at a cost of $62.00. This purchase adds $27 of annual dividend income.

Positions Sold this week:

SOLD 2 FSLY options bought this week for $22.10 each. Profit of $6.70 for each contract, totaling a gain of $1,340.

Here is an updated look at the current portfolio:

The portfolio has been on a tear if you have been following along on the trades. Hit a solid swing trade this week with FSLY. Bought a lot more time than I needed to, but did not expect a 10% swing the day after I bought it, which sent the option I bought flying above 60%. In fact, I was in the drive-thru line of SBUX when I sold the option.

STORE Capital and Crowdstrike have been my best performing positions to date, both up 20% since purchasing them this month.

This portfolio is now projected to earn $640 in annual dividend income, which is good for a portfolio dividend of 4.4%.

New Resource On REITs

Today is the FINAL DAY to get my book on REITs at the presale price of $10. The book will be released tomorrow, 9/1 and the price will go up!

The book is titled “A Guide To Understanding REITs.”

Being that Real Estate is a sector I have worked in for a number of years, REITs are a passion of mine and an area I look to have roughly 20-25% exposure to.

If you are interested in obtaining a copy, I will leave the presale price up for subscribers. Click HERE to obtain a copy.

As always, if you have any questions at all, please feel free to DM me on Twitter or simply email me at Dividend.Seekerinvesting@gmail.com.

Have a great week!

Mark