The Fed Hit Pause, Now What?

Markets move into Extreme Greed levels, which creates near-term investing concerns

Welcome to the 106 new subscribers who joined The Dividend Investor’s Edge, the premiere investing newsletter for those looking to keep up with the stock market and dividend stocks. We now have a community of more than 9,800 subscribers striving to be better and more well informed investors. If this is your first time reading, but you have not yet subscribed, join our growing investing community of like-minded investors looking to reach financial independence.

Webull is an investing platform for investors of all levels. The platform has a lot of useful tools to make the process of investing simple and easy. Right now they have a special promotion that could earn you up to 12 FREE stocks valued up to $30,000. You can receive this promotion just by OPENING a new account and depositing ANY amount of money.

Click HERE to take advantage of this special time promotion.

*This is sponsored advertising content.

Market Talk ⏪

We always begin with 5 important topics from the week prior and/or related to the week ahead for investors to be mindful of. If you could LIKE the article it would be greatly appreciated.

Federal Reserve hits the pause button. The Federal Reserve decided to pause their rate hike cycle, which could be viewed by many more as a skip. This move was widely anticipated, similar to what many economists believe will be another hike in July. Fed Chair Jerome Powell did surprise during the press briefing when he alluded to not one, but two remaining hikes with no cuts expected for a “few years.” The stock market was able to shake much of this off, but something seems likely to give. When that happens, could be sooner rather than later.

More poor economic data from China. The People’s Bank of China moved to cut two more leading rates for the first time in 10 months, as the bank continues to try and slow the poor economic data. From here, economists believe more is coming, such as adjustments to reserve requirements and bank loan quotas. Some see China falling into a period of deflation, which is the opposite of what many expected once the zero COVID policy restrictions were removed. This could weigh on China related stocks here in the US.

CPI continues to trend in the right direction. Last week we got a look at the May CPI report, which showed CPI grew 0.1% month over month and 4% year over year. This was the lowest year over year level we have seen in two years. When you look at core CPI, which excludes the more volatile food and energy items, it showed growth of 0.4% month over month and 5.3% year over year. Energy prices fell 3.6% during the month of May, which certainly helped keep CPI levels lower. Food prices still remained high, growing 6.7% from prior year, but overall things are trending in the right direction.

Housing has an inventory problem. As many of you already know, mortgage rates have ballooned from below 3% just a few years ago to rates coming close to 7% these days. Nearly 2/3 of mortgage holders have an interest rate below 4%, which makes current homeowners staying put. It does not make much sense for those with low mortgage rates to even considering moving. High mortgage rates combined with low inventory makes things extremely difficult for first-time homebuilders. These buyers play an important role in the direction of the real estate sector.

The US retailer remains resilient. This economy has been extremely resilient with low unemployment, making the labor force quite strong, which is one reason the inflation numbers have remained high throughout the past few years. This leads us to retail sales data, which we just got last week, showing volume increased 0.3% in May, which follows a 0.4% jump in April. Analysts were expecting a decline of 0.1%.

Deep Dive 📰

Become a PREMIUM subscriber today for LESS than $1 per day and take your investing to the next level. Premium subscribers receive the following:

Monthly Portfolio Updates

2 Individual Stock Deep Dives Per Month

Valuation Dashboard

Subscriber only content

Subscribers will be receiving the Valuation Dashboard next, after we complete our latest DCF analysis.

Go PREMIUM today!

US Markets 🇺🇸

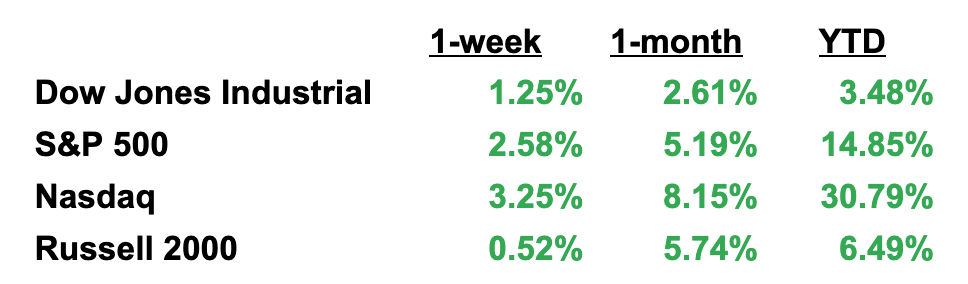

Here is a performance summary for US Equities:

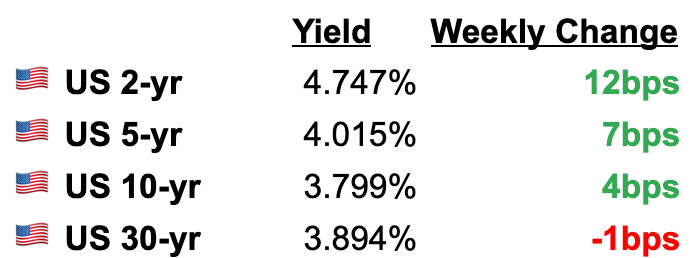

Here is a look at US Treasuries:

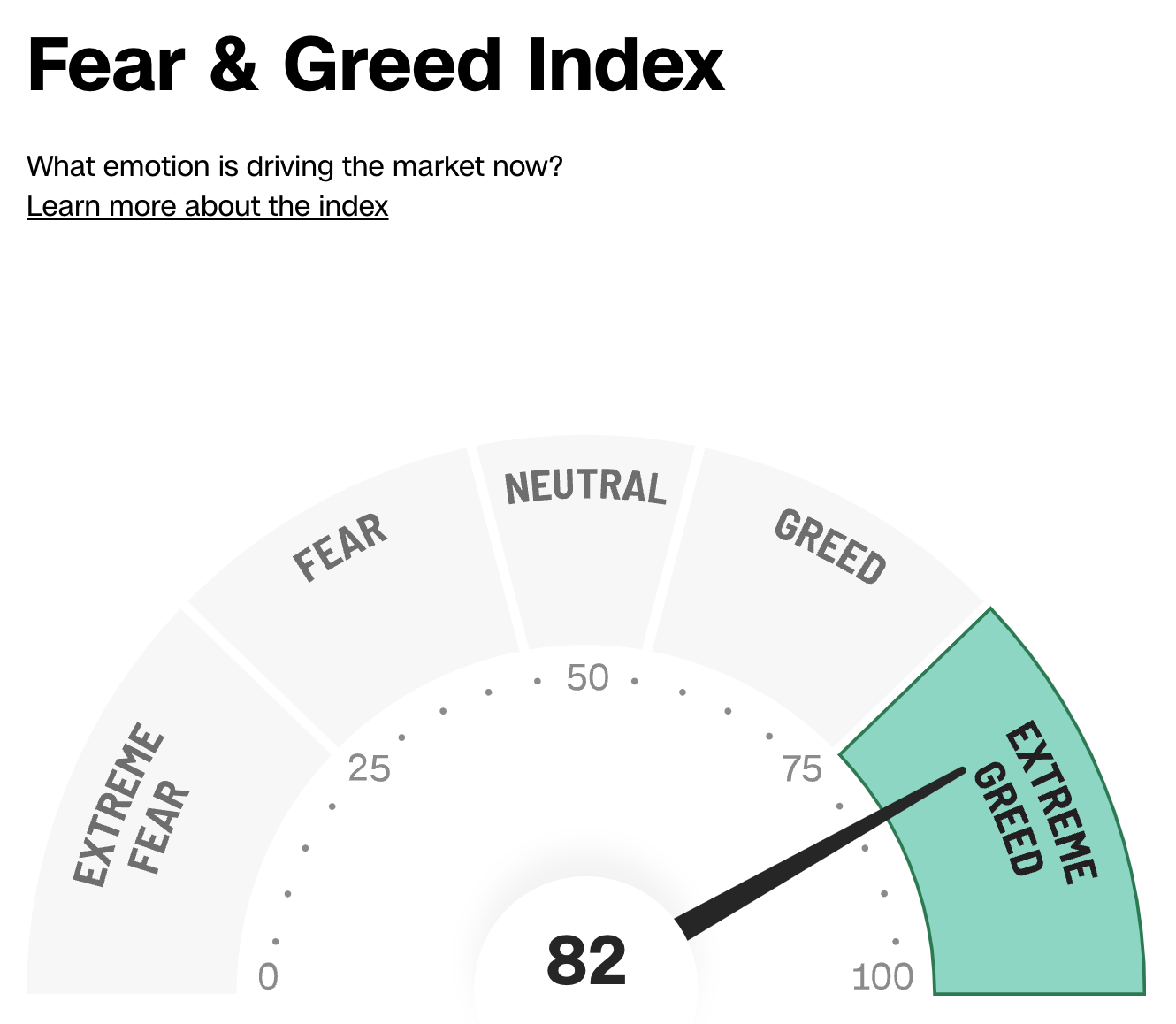

The Fear & Greed Index measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

The Fear and Greed Index remained in the EXTREME GREED territory, which gives me plenty of reason to proceed the market with caution in the near-term. Currently, the index has a reading of 82, which is in line with the prior week reading of 77.

Earnings on Deck 💰

Earnings season is pretty much over, as such, we get another slow week of earnings releases with a few notable names. Here is a look at who's reporting this week:

Dividend News 📝

Here are some notable analyst upgrade/downgrades from the previous week:

Goldman Sachs upgrades Devon Energy to buy from neutral

HSBC upgrades Emerson Electric to buy from hold

Bank of America initiates S&P Global and Moody’s as buy

Citi adds a negative catalyst watch on American Express

Stifel upgrades Domino’s to buy from hold

UBS upgrades AutoZone to buy from neutral

Economic Data This Week 📆

Monday

MARKET CLOSED

Tuesday

Housing starts and permits (May)

Wednesday

Fed chair Jerome Powell delivers the Semiannual Monetary Policy Report to House Financial Services Committee

Senate Banking Committee nomination hearing for Fed vice chair-nominee Philip Jefferson, Fed governor Lisa Cook and Fed governor nominee Adriana Kugler

Thursday

Fed governor Christopher Waller speaks in Dublin

Initial jobless claims (week ended June 17)

Fed chair Jerome Powell delivers Semiannual Monetary Policy Report to Senate Banking Committee

Existing home sales (May)

Friday

S&P Global PMI composite (June)

Other Resources 📺

If you have not done so yet, check out my growing YouTube community where I publish weekly videos focused on building wealth through investing.

Here is the latest video I released: 3 of the BEST Dividend Growth Stocks:

Here is another video I put out last week: Earn Dividend Income EVERY Month With These 3 Stocks:

Here are a few others of my latest videos:

Ranking These 10 REITs From BEST to WORST

Dividend Portfolio Update: My Top 5 Positions

4 of the BEST Dividend Growth ETFs

2 Dividend Stocks To Buy & Hold For the Next Decade

How Investing $100,000 in SCHD Can Be Life Changing

3 High-Yield Dividend Stocks That Look Cheap

3 of the BEST Dividend Kings For The Rest of 2023

Skip JEPI and buy these Dividend ETFs

The Power of Dividend Investing

The New Look SCHD: Still The Best Dividend ETF

3 MONTHLY Paying Dividend Stocks To Buy

Top 10 Dividend Stocks For 2023

If you enjoyed the newsletter, leave a LIKE and COMMENT down below. Also, if there is someone that could benefit from this newsletter, consider sharing it.

Have questions? You can email me directly at Mark@RoussinFinancial.com.

Happy Investing!

Mark