US Stock Market Due For More Pain Ahead

Plan accordingly as the Federal Reserve plans for another round of rate hikes this week

The Dividend Investor’s Edge is a weekly newsletter designed to give you, the investor, a better understanding on where the stock market is, and to better equip you with information to help you make more informed decisions going forward.

This newsletter is designed for investors of all levels. Whether you are just starting out or a seasoned investor, it is our goal to deliver information in a format that is easy to articulate.

Thanks for reading The Dividend Investor's Edge!

Thanks for reading The Dividend Investor's Edge! Subscribe today so you are notified anytime we drop new content.

Please COMMENT below on your thoughts of the newsletter.

📈 Quick Look At The Markets 📉

Before we begin, be on the lookout for our first Stock Analysis report that I will be sending out to subscribers this week. In addition, I just launched a BRAND NEW Discord Community called Cashflow University. At CFU we focus primarily on helping you build passive income. We have dedicated topics that include:

Selling Covered Calls, Cash Secured Puts, and Option Spreads

Dividend Stocks

Real Estate Rental Properties

Turo Car Rental

Crypto Mining

And MUCH MORE

JOIN CASHFLOW UNIVERSITY TODAY

The US markets got crushed this week as we got hotter than expected inflation, something we were worried about in last week’s newsletter, but we also combined that will some weak comments out of FedEx (FDX).

Last week we saw the release of the CPI report, which measures inflation, and saw inflation was up 8.3% over the past year and up 0.1% from prior month. These numbers were ahead of expectations, which sent the markets into a tailspin.

The Federal Reserve had been warning us all week lead up to the report with their intentions on continuing to attack inflation hard and that “pain” would still be coming. Well, investors saw the pain from a continued red-hot CPI report and now a pending Fed decision on whether they will once again hike rates another 75 basis points or take it a step further to 100 basis points.

Bond yields also climbed higher as the 10 year now sits at 3.45%, the 5 year at 3.63%, and the 2 year at an incredible 3.87%. The bond market is flashing recession signals any way you look at it. The yield inversion between the 30 year yield and the two year yield is the steepest we have seen in nearly 22 years.

An inverted yield curve, which simply means the lower year bond yields are higher than the longer term bond yields, is a closely watched indicator of a potential recession in the near term. Do not forget, the bond market is larger than the US market, and should be followed when investing in stocks.

Given where bonds are at, it is having more and more look to the idea of moving more money towards bonds given the weak performance in stocks and the near 4% risk-free return you could get in bonds.

The CPI data was a tough pill to swallow, but then at the end of the week, FedEx, which is one of the largest package delivery companies in the world, reported weak earnings, poor guidance, and on top of all that, the CEO said that he see’s a worldwide recession coming.

This is really what sent the markets into a tailspin, as FDX has a unique look at economic activity around the world, and the slowdown in volumes had their leadership team concerned.

Here is a look at the heat map over the past week for the S&P 500. Year-to-date the S&P 500 is down 19.3%, after falling 5.4% last week.

Top Sectors For The Week

All sectors were RED

Worst Sectors For The Week (No sectors in the red this week)

Materials -6.65%

Real Estate -6.48%

Communication Services -6.43%

Fear Factor

Fear and uncertainty is often expressed in the stock market through volatility. One way for investors to understand where the market as a whole is at in terms of volatility is by monitoring the CBOE Volatility Index (VIX). The VIX represents the market’s expectations for near-term price changes within the S&P 500 index. The index is derived based on S&P 500 index options with near-term expiration dates, projecting a 30-day forward projection.

The VIX ended the week with a reading of 26.3 with the 50-day moving average finishing at 23.58. The VIX creeped higher given all the selling and negativity coming out of the market last week. Given that the VIX now has an elevated reading, we could expect near-term volatility to continue in the coming week. A reading under 20 is when I consider things to be closer to normal.

Here is a look at the VIX chart with the 50-day moving average:

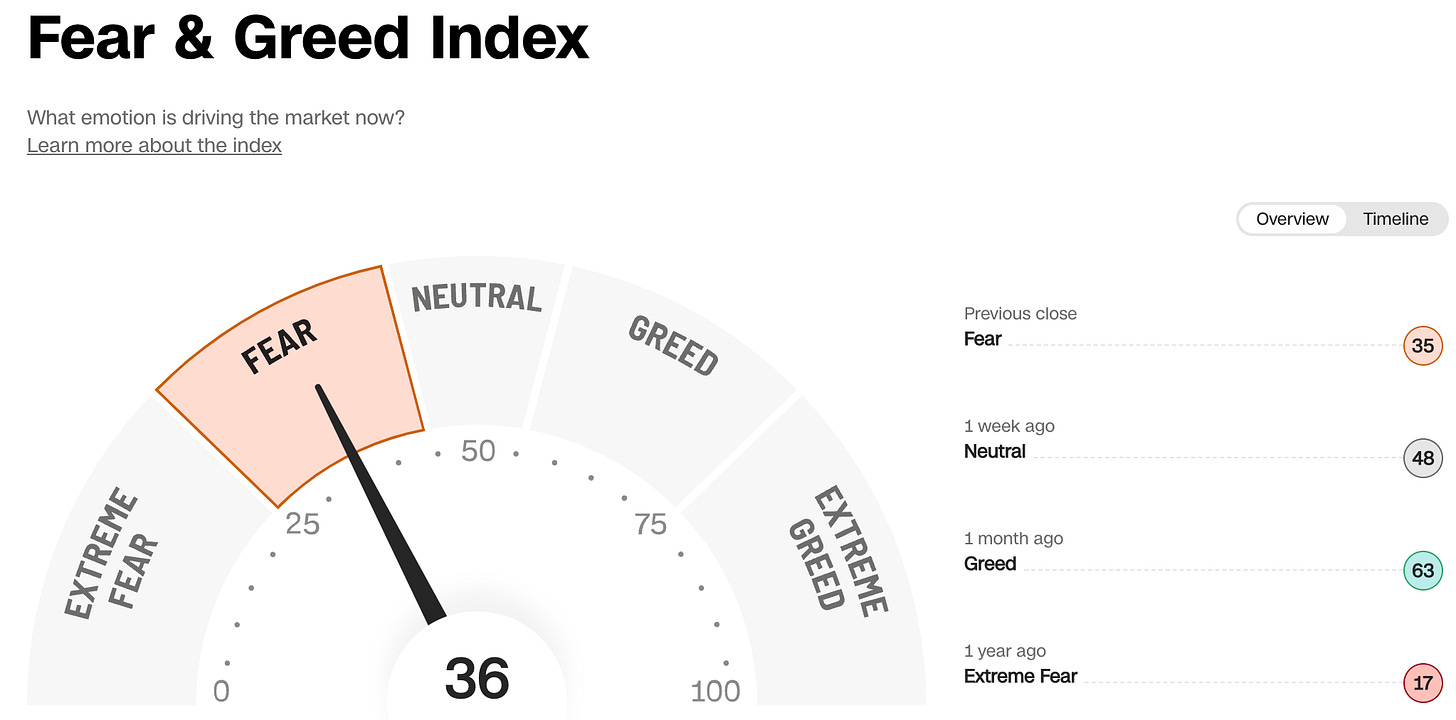

Another resource you can look at is the Fear & Greed Index, which measures market sentiment based on the following seven factors: put/call ratios, junk bond demand, stock price breadth, market volatility, stock price strength, safe-haven demand, and market momentum.

When it comes to the Fear and Greed Index, things moved sharply into the direction of Fear after inflation levels remained high and the impression that a recession is imminent began to become more clear. Currently, the index has a reading of 36. This reading is slightly up from a rating of 45 last week.

📰 Stock Market: A Look Ahead 📰

In this section labeled “Stock Market: A Look Ahead” I will discuss a variety of different topics that face the market in the coming week(s) ahead. Remember that the stock market is forward looking , typically looking roughly six months ahead.

We just went through a week of CPI data, which the Federal Reserve had a week to digest, as levels remained high and recent Fed hikes failed to make much of an impact thus far. With that in mind, this week is “Decision Week” as the Federal Reserve is expected to yet again hike the Fed Funds rate.

It is not a matter of IF the Federal Reserve will hike rates, it’s more like HOW MUCH will they hike rates. Will it be 75 basis points or 100 basis points is the questions?

After the red hot CPI report we saw last week, I do not think a 100 basis point rate hike can be thrown out. It is very likely the Fed continues to move swiftly, especially after the late start they got to this entire cycle. A 75 basis point hike still remains the consensus pick, with 80% believing this to be the result this week. However, last week only 10% from the CME FedWatch survey saw a 100 basis point hike, but that has now doubled after the latest CPI results.

If any of you watch CNBC, you probably know Tom Lee from Fundstrat Global Advisors, who is usually very bullish on stocks. Mark Newton, who is part of the Fundtrat team as a Managing Director and Head of Technical Strategy. He was on CNBC last week, suggesting that the S&P 500 could pullback to around $3,685 (closed Friday at $3,873), implying another 5% leg lower until bottoming. These levels would put us right at the June lows, which is a level many technicians have suggested that we would retest.

This suggests that ‘Cash is King’ right now and would provide opportunity for investors to get in some great high-quality stocks in the coming weeks.

Do not forget, as i have mentioned in prior newsletters, September is historically the weakest month of the year for equities.

The Fed hike decision will come on Wednesday 9/21 at 2pm EST.

With that being said, I believe we will continue to see turbulence in the market this week.

💵 3 Quick Pick Dividend Ideas 💵

In this section, I will share 3 high level dividend ideas that are at the top of my watchlist. My personal plan will be less focused on adding shares this week and more focused on my options plays. I will be selling covered calls and cash secured puts.

Want to learn how to do that? Join my BRAND NEW Discord community where I, along with numerous other teachers share their trades. Join us at Cash Flow University. Please remember that I am not a financial advisor, so please perform your due diligence before investing.

Quick Pick #1 - Alexandria Real Estate (ARE)

Stock Price: $150.66

Current P/AFFO: 23.3x

Forward P/AFFO: 20.44x

5-Yr Avg P/AFFO: 30.0x

Quick Pick #2 - NETSTREIT (NTST)

Stock Price: $19.50

Current P/AFFO: 17.8x

Forward P/AFFO: 15.7x

5-Yr Avg P/E: 26.3x

Comment: Only a 2+ year old public company providing a lot of opportunity for those looking for smaller cap REITs.

Quick Pick #3 - Energy Transfer (ET)

Stock Price: $41.61

Current P/E: 7.92x

Forward P/E: 7.35x

5-Yr Avg P/E: 10.70x

💰 Dividend News

In this section I will detail what I am watching and any Dividend related news.

Texas Instruments (TXN) increased their dividend by 8%

Innovative Industrial Properties (IIPR) increased their dividend by 2.9%

Philip Morris (PM) increased their dividend by 1.6%

Keurig Dr Pepper (KDP) increased their dividend by 6.7%

US Bancorp (USB) increased their dividend by 4%

Deutsch Bank and Morgan Stanley increases PT of Starbucks (SBUX) to $101 and $96, respectively, after a successful Investor Day last week.

Other Resources

If you have not done so yet, definitely check out my growing YouTube community where I publish weekly videos on Dividend Stocks I am looking at.

Here is a look at my most recent video in which I detailed out 3 Cheap Dividend Stocks. Give it a view and a LIKE here:

Want a look at my personal Dividend Portfolio? Here is my latest update.

Here are a few other YouTube videos to watch:

HUGE DIVIDENDS From These 3 REITs

5 Best Dividend Stocks To Buy and Hold FOREVER

5 Dividend Growth Stocks To Buy Now

New to investing or looking for a new brokerage? Check out Webull where they have a special promotion where they will give you 12 FREE STOCKS valued up to $30,600. Sign up, deposit ANY amount of money BEFORE the end of the month and get your free stocks. Click HERE for the promotion.

That concludes today’s newsletter. I hope you all have a great week and wish you the best of luck on your investing journey.

If you do not already follow me on social media, give me a follow as I put out weekly content.

Thank you for reading my newsletter! Please comment down below and share the newsletter with someone that may find it useful.

Have questions? You can email me directly at Mark@RoussinFinancial.com.

Have a Great Week!

Mark

Thanks for reading The Dividend Investor's Edge! Subscribe for free to receive new posts and support my work.